Villi 2021 Industry Survey Results

Positive Results and Optimism Dominate Villi Industry Survey Responses.

Pandemic Impact more boom than bust for Villi clients.

Surprising upside and a bright future outlook were the most prevalent messages from respondents to Villi’s 2021 Industry Survey. Despite having to weather dramatic changes to their showroom and supply chain business models, a large majority reported better sales, more focused clients and an uptick in commercial projects in 2020.

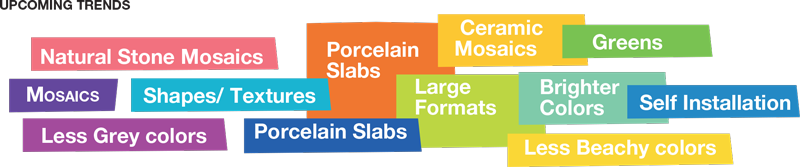

Each year, Villi queries its client base across the United States looking at the past year’s performance and ahead to anticipated trends. Noted by a strong number of responses, the survey’s key findings were a keen look at positive trends in sales for 2021, some shifts in preference to large format porcelain for economy reasons and a continued expectation of strong sales in glass and glass mosaics.

More than 55% of respondents reported they were more hopeful for their business’ prospects now than six months ago. And, more than 80% believe sales of glass tile and mosaics will stay strong or increase in the coming year.

Most importantly, respondents were happily surprised that in a year noted primarily for negative pandemic impact to many industries, 2020 was a boom year for the design industry. Positive sales increases were the most often mentioned comment when asked to describe the most unexpected impact of the pandemic.

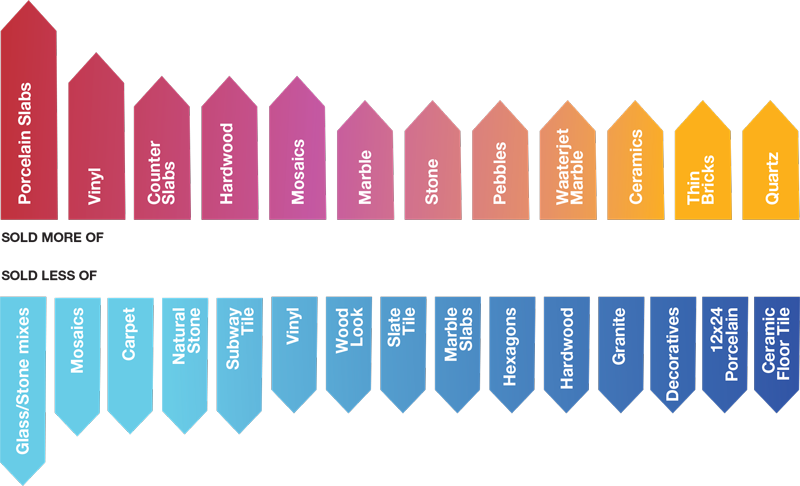

Respondents were also asked to name the products they sold more of and less of in 2020.

The pandemic may have made architects, designers and even homeowners more cost-conscious than ever before as most predictions for notable trends in 2021 included a continued shift to lower cost porcelain products and large format applications.

As client showroom visits continue to be difficult to safely execute, respondents looked to their suppliers to continue to provide new product samples but emphasized an interest in coordinated Direct to Consumer sample programs. Continued showroom presentations by vendors slightly outpaced a desire for virtual Product Knowledge sessions and other digital communication strategies. It remains important that designers and sales personnel have real product in their hands when making recommendations and they voiced a preference for in-person contact with vendors and sales reps.